By Brian Spinelli, CFP®, AIF®, Chair of Investment Committee/Senior Wealth Advisor

What, exactly, is International investing?

Over the last few years, a lot of attention has been focused on the U.S. stock market. The purpose of this piece is to keep things high level for those who want to gain familiarity with investing internationally. We will focus solely on investing in stocks in this piece – but do keep in mind that bonds and real estate are major parts of the international investment landscape.

Embracing opportunities globally

Many investors make the choice to only invest in their home country markets because these are more familiar and easier to understand. However, by doing so they are actively avoiding many global companies that do not trade in their home markets. When U.S. residents invest only in stocks that trade in the U.S., they miss out on exposure to about 40% of the rest of the world’s stock opportunities.

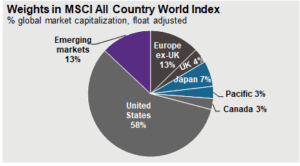

The graphic below is helpful to reference. Sure, a lot of stocks that trade in U.S. markets have sources of revenue in foreign countries, so it’s not like investors in these markets have zero exposure to international markets. Nonetheless, their exposure to these markets is generally limited – and really not on the same level as buying stocks traded outside the U.S. market. An index we look at closely is the MSCI All Country World Index. MSCI stands for Morgan Stanley Capital International, the firm that designed and manages the index components. This particular index has weights to each market based on its size, also known as “market-cap-weighting.” It is widely looked to by asset managers as a measure of how the broad stock markets globablly are doing. As of March 31, 2021, the U.S. market made up 58% of the index based on how big it is relative to other markets.

| Source: FactSet, Federal Reserve, MSCI, Standard & Poor’s, J.P. Morgan Asset Management. All return values are MSCI Gross Index (official) data. Guide to the Markets – U.S. Data are as of March 31, 2021. |

The “other” 42 percent

While the U.S. stock market is vast and attracts a lot of money globally, there are many other countries with capital markets that deserve attention. Many of those countries domicile major global companies that simply aren’t traded on U.S. markets. Here is one of my favorite examples: Look around your home to see if you own anything made by Samsung Electronics. It’s frankly hard for me to not see something made by Samsung just going about my course of daily living. Samsung is domiciled in South Korea and the stock is held on foreign stock exchanges. If you wanted some ownership in Samsung you would have to look to foreign markets.

In fact, MSCI still classifies South Korea as an emerging market. The 13% you see in purple in the chart above is where you would find a stock like Samsung. The other major country that dominates that part of the index is China. There are ongoing debates over whether both have reached developed status like the U.S. and Europe, but we are not going to delve into that topic here.

The following graphic from MSCI helps show how their All Country World Index exposes one to many different countries with different economies and growth rates.

Source: MSCI

Accessing international stock markets used to be quite costly and complex for individual investors. However, with the proliferation of mutual funds and exchange-traded funds, the costs and hurdles have come down significantly over the past 20 years. However, if you still want direct exposure to a company like Samsung, there are hurdles. You would have to open an account in the country you are targeting, take your U.S. dollars, covert them to the local currency, and then have a broker buy the stock on your behalf.

Paying attention to foreign currency exposures

At a very high level, there are a lot of issues that come into play when going this route. One in particular is tax complexities. Another key point for those learning about international investing is that it involves currency conversion. If you buy a U.S. stock with U.S. dollars there is no need to covert currency. However, when U.S. investors are exposed to investments outside the U.S., they have an additional component driving their returns. They’ll need to consider how the foreign currency performs relative to the U.S. dollar.

The U.S. investor is likely going to want to know how much money they have invested in U.S. dollar terms. If they own foreign stocks, their returns are going to be influenced partially by how the U.S. dollar behaves relative to the countries and currencies their international investments are exposed to. If you’re investing internationally and the U.S. dollar is declining relative to these foreign currencies, this actually serves as a tailwind and enhances returns. However, if the dollar gets stronger, this can go the other way.

Value and growth opportunities

In recent years, U.S. stocks have had very strong returns, while investing outside the U.S. has not been as robust. Looking at international markets currently, their valuation metrics look more attractive relative to their U.S. counterparts. All this means is that right now, investors are paying less for companies outside U.S. markets – and this may be attractive to investors with long-term views.

Investment markets and opportunities globally continue to change and develop. While it is easier to simply focus only on opportunities in your home market, we encourage investors to consider growth opportunities that may exist elsewhere. International investing also offers additional ways to diversify your investments and add companies to your portfolio that likely will behave differently than those in your home markets. Investment products today reduce the hurdles to be globally invested and do so at very competitive costs.

How do you balance having the life you want to enjoy today with what you’re going to need in the future? Are you doing what it takes to enter your dream retirement? TAKE OUR QUIZ to find out.

Disclaimer

Halbert Hargrove Global Advisors, LLC (“HH”) is an SEC registered investment adviser located in Long Beach, California. Registration does not imply a certain level of skill or training. Additional information about HH, including our registration status, fees, and services can be found at www.halberthargrove.com. This blog is provided for informational purposes only and should not be construed as personalized investment advice. It should not be construed as a solicitation to offer personal securities transactions or provide personalized investment advice. The information provided does not constitute any legal, tax or accounting advice. We recommend that you seek the advice of a qualified attorney and accountant.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without previous notice. There is no guarantee any forward-looking statement will come to pass. All information presented herein is considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. This material should not be relied upon by you in evaluating the merits of investing in any securities or products mentioned herein. In addition, the Investor should make an independent assessment of the legal, regulatory, tax, credit, and accounting and determine, together with their own professional advisers if any of the investments mentioned herein are suitable to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yield may not be a reliable guide to future performance. Any reference to a market index is included for illustrative purposes only as it is not possible to directly invest in an index.