By David Koch, CFP®, AIF®, CEPA® ,CFA, Director of Portfolio Management/Senior Wealth Advisor

The Berkshire Hathaway (BRK) Annual Shareholders Meeting is held annually in Omaha, Nebraska, typically on the first Saturday of May. Anyone who owns at least one share of Berkshire Hathaway stock (Class A or Class B) can attend. While Jimi Hendrix and Janis Joplin won’t be performing, the event in Omaha has been dubbed “Woodstock for Capitalists” and often has comedy skits, music, and SWAG (Stuff We All Get) passed out by See’s Candy and Brooks Running, both of which are BRK holdings.

It was announced at this year’s meeting on May 3 that Greg Abel will become CEO of Berkshire Hathaway, succeeding Warren Buffett after Buffet has run the company for more than 60 years. Warren’s investing quotes are some of the most erudite and re-quoted of all investors. Greg, who has big shoes to fill, and will step into his new role on January 1, 2026.

A Buffet of Warren Buffet Quotes

Buffet is known to have some of the greatest investing quotes. Let’s hope that Abel has some in his back pocket for us too:

“Risk comes from not knowing what you’re doing.”

“Chains of habit are too light to be felt until they are too heavy to be broken.”

“Someone is sitting in the shade today because someone planted a tree a long time ago.”

“Predicting rain doesn’t count. Building arks does.”

“It’s better to hang out with people better than you.”

“The best investment you can make is in yourself.”

– Warren Buffet

Why Warren Buffett Prefers C-Corps Over Investment Funds

In 1956, Buffett started Buffett Partnership, an investment fund, with famously, just $105,100 in capital from family and friends. After four years he decided to unwind the fund, partly because he said he was having a hard time finding value investments, and partly because the fund structure isn’t meant for very long-term investing.

Holding cash can be a drag on performance in an investment fund when the market is going up. Sometimes, if you think there will be better investment opportunities, a manager would like to hold cash, but typically, timing the market is the responsibility of the investor, not the fund manager.

What Warren experienced early on in his career is how terrible people tend to be at timing the market. Just when the market was going down, his investors wanted to redeem shares of his fund, but he wanted to hold the cash to deploy at cheaper valuations.

The advantage – and here’s the kicker – is that if a corporation wants to hold cash, their investors can sell their shares to other people in the open market. When they sell their shares, it has zero impact on the cash holdings of the company. The cash isn’t needed to redeem shares like a fund is required to from those investors who want to exit. Buffet can therefore hold as much [or as little] cash as he sees fit, and right now BRK is sitting on nearly $350 billion of it.

Inside Berkshire Hathaway: Private Holdings, Cash Reserves, and Public Investments

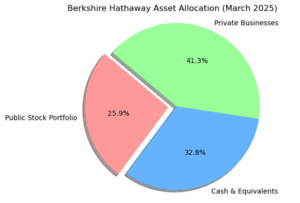

In 1964, Warren purchased Berkshire Hathaway, a failing textile company. Today, BRK is a holding company, long abandoning textiles in 1985. The company now buys and sells other companies, some public, some private. Currently (as of March 2025), the assets of BRK are a little more than 40% private company holdings, about 25% public company holdings, and about one-third in cash.

Source: List of assets owned by Berkshire Hathaway – Wikipedia

Here are some of Berkshire’s private holdings:

- BNSF Railway

- Berkshire Hathaway Energy

- GEICO

- Dairy Queen

- Duracell

- Precision Castparts

- See’s Candies

- NetJets

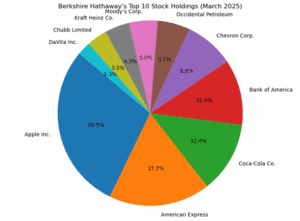

While cash is a necessity to hold as a part of BRK’s insurance businesses, GEICO, Berkshire Life, Specialty Insurance, and General RE (insurance companies are required to hold cash), $350 billion is still an enormous amount. $350 billion puts BRK’s cash reserves somewhere between the GDP of Egypt and the Czech Republic! Of the roughly 25% in public companies, this is the current breakdown with Apple being the favorite:

Source: Warren Buffett Portfolio 2025 & Berkshire Hathaway Holdings

Live Long and Prosper

Last but not least, Warren’s wealth is very much the result of longevity. Buffet turned 80 in 2010, and at the time his estimated net worth was around $47 billion. As of 2025, his estimated net worth is approximately $158 billion. Almost over 90% of his wealth was accumulated after his 65th birthday; imagine if he had just retired then?

Disclosure:

Halbert Hargrove Global Advisors, LLC (“HH”) is an SEC registered investment adviser located in Long Beach, California. Registration does not imply a certain level of skill or training. Additional information about HH, including our registration status, fees, and services can be found at www.halberthargrove.com. This blog is provided for informational purposes only and should not be construed as personalized investment advice. It should not be construed as a solicitation to offer personal securities transactions or provide personalized investment advice. The information provided does not constitute any legal, tax or accounting advice. We recommend that you seek the advice of a qualified attorney and accountant.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment. Any reference to a specific product, investment, company, etc. is for informational purposes only and should not be construed as a recommendation or endorsement. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without previous notice. There is no guarantee any forward-looking statement will come to pass. All opinions or views reflect the judgment of the author as of the publication date and are subject to change without notice. All information presented herein is considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. This material should not be relied upon by you in evaluating the merits of investing in any securities or products mentioned herein. In addition, the Investor should make an independent assessment of the legal, regulatory, tax, credit, and accounting and determine, together with their own professional advisers if any of the investments mentioned herein are suitable to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yield may not be a reliable guide to future performance. Any reference to a market index is included for illustrative purposes only as it is not possible to directly invest in an index.