RIA Survey & Ranking 2017

JULY 5, 2017

Click here to view the Top 50 Fastest Growing RIAs.

In theory, no business likes volatility, just as no boat captain wants to deal with choppy waters. Small companies don’t like planning revenue of $5 million one year and $3.8 million the next.

Nor do they like regulation that’s up in the air. For the past few years, advisors have had to wonder about what kind of impact the Department of Labor’s rule on advisors’ fiduciary responsibilities would have on their business.

RIAs, by definition, are fiduciaries and proud of it. Many use it to market their services as client-centric, so the DOL rule had less impact on their business than on planners with brokerage licenses. But the election of Donald Trump suddenly had people wondering whether the new rule would go “poof.” Then to the shock of many, the rule went through anyway, though regulators in the nation’s capital keep talking about modifying it.

However, if you talk to many financial advisors, volatility in markets and politics has been a friend, because in times of trouble, people need unbiased counsel and that is the brand RIAs have burnished for themselves. In times of sluggish market growth, people are scared and want help. Think 2015, when the S&P 500 returned slightly less than zero.

“Clients tend to be more interested in hiring an advisor when the economy is weaker and/or there is heightened volatility in the markets,” said one respondent to Financial Advisor’s 2016 RIA survey.

In 2016, however, the S&P 500 grew by just shy of 10%, and while that means RIA firms have rising assets, revenue—and by extension, higher valuations to sell their firms, if they want to—it doesn’t necessarily put more clients in play. In fact, in good markets with robots offering a lot of investment management services and low-cost passive indexes available, people think they might not need help at all.

Ask Ken Moraif, of Money Matters with Ken Moraif, headquartered in Plano, Texas. Despite his firm’s client growth of more than 30% and 9.25% asset growth between 2014 and 2015, he shrugs off 2016, saying it was a fairly lackluster year for his business.

“Our business is helped when there is volatility, so 2016 was actually not the best of our years,” Moraif says. “Right now, the complacency that we are seeing with investors, where they are just hanging in there and the market is just doing nothing but going up, makes it difficult for them to want to seek out a financial advisor when they feel they can do it themselves.”

Yet it’s almost certain, now that valuations are high and some savants are predicting a downturn or correction, that professionals realize it’s good to make hay while the sun is shining. Advisors in good times have to look to the future, thinking of reinforcing their defenses. That might mean expansion—bigger national footprints to diversify sources of wealth and client demographics. Monastic purity is also a virtue: They might also stick to a special boutique strategy or market aggressively to their one true niche.

Moraif, a mass marketer and radio personality, has a specific focus of people five years away from retirement or five years into it. “So that 10-year period is what we specialize in and what we focus all of our attention [on] in terms of our expertise and in terms of the information that we put out through media, etc. … Our average client is 59 years old and has a portfolio of $400,000 or $500,000. They are not multi-millionaires.” The goal is to give them service as if they were.

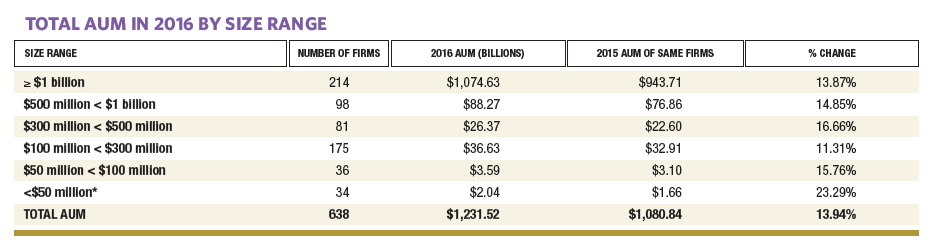

The market growth and consolidation have in any case led to bigger, more fearsome RIA firms. In 2012, when Financial Advisor performed its RIA survey, some 120 firms listed assets of a billion or more. The number is now just north of 200, after a wave of mega-mergers.

A group of serial acquirers enlisting private equity money for roll-ups are writing big checks. But cashing out isn’t the primary goal of many firms. Others are looking for growth, adding new services and ensuring succession. Sometimes that has prompted firms to strike marriages of RIA equals; in other cases, it means combining with another firm offering complementary services or residing in an adjacent market.

David DeVoe of consulting firm and investment bank DeVoe & Company, says that 2016 was a record year for merger and acquisition activity, which is part of a broader trend. (The firm tracked 44 deals in the first quarter of 2017, a record, he says, and tracked 145 deals in all of 2016.)

“In many cases, firms were selling or merging to achieve the benefits of scale,” DeVoe says. “In some cases [that means] being part of a broader platform and having more capabilities and services to offer their clients. In other cases, a sale provides the advisors with an opportunity to move the operational or regulatory, less attractive elements off their plates.” This is nearly an ideal time to sell, he says, because the economy is doing well and valuations have steadily increased over the last 10 years to above average. Again, a lot of advisors might say the iron is hot now.

“If 2008 hit again, it would likely delay their decision to sell for three or even four years,” he says. “Any advisor with that scar tissue from 2008 can’t help but include it in some of the calculus they’re doing.”

For the buyers, there are advantages to national expansion. One firm with a large national footprint reported in the survey, “We have benefited from an overall uptick in the broader markets. Because our clients and their businesses are disbursed nationwide, we are less influenced by our local economy than from macroeconomic trends.”

Consolidators, roll-up firms often brandishing private equity money, dominated the first quarter of 2017, but over the last couple of years they’ve been overshadowed by RIAs buying one another. DeVoe says, “There’s something to be said for an RIA seller talking to an RIA buyer. There is an easier psychological journey to complete that transaction. There’s already a degree of respect and admiration among heads of those organizations. They are truly part of the same community.” A consolidator, by contrast, “is perceived as essentially an arm’s length transaction or someone who might be closer to private equity than an RIA business.”

One such large merger last year wedded New York firm Tiedemann Wealth Management with San Francisco’s Presidio Capital Advisors, a match that spawned a new firm with $13 billion in assets under management. Tiedemann was founded by the late Carl Tiedemann in 1999 as a Delaware trust company to serve families moving away from bulge bracket firms and into family offices.

The firm had a tony clientele and had been wary of mergers for most of its existence. Carl’s son, Michael Tiedemann, the firm’s current CEO and CIO, says the firm had been growing just fine on its own, thank you very much, by pitching itself to a network of referral sources, including current clients, lawyers and accountants working for the firm’s target clients with $25 million minimums. Tiedemann hadn’t done this by marketing or cold calling, but by being in the right niche and having its names on people’s lips at the right lunches, board meetings and golf courses.

“Tiedemann has grown organically for the first 16 years of its existence,” Michael Tiedemann said in an interview with Financial Advisor. “We had been growing in the low teens and it was a way for us to manage growth effectively. Organic growth is healthy if you’re lucky enough to have it.”

Also, the firm never wanted to be part of a bad marriage. But with Presidio, Tiedemann had found not only a culture fit, but a larger geographical footprint—in places like San Francisco, Dallas and Washington, D.C.

The advantage of going bigger, says Tiedemann, was that, “invariably, wealthy families tend to spread across the country. The parents perhaps live in Massachusetts or Florida or Georgia, but their kids go to universities, then they fall in love with an individual or city and they end up in Austin, Texas, or Los Angeles.

“We’re in the tech, financial, political, energy and arguably retirement [capitals] of the U.S., so in terms of core industries that are generating wealth or have created wealth, there are also talent pools drawn to [these places], there are money managers … there are less obvious reasons to be in those markets.” In some cities, you simply need to be on the ground for wealthy people who want to walk into your office, he says.

The independent RIA boutique model exploded in 1999, says Tiedemann, not unlike hedge funds, but “what is occurring now is most of these RIAs are being built to sell. They are practices, not institutions,” he believes. “The combination of the interest to monetize 10 to 15 years of work or success or the need to institutionalize the practice—fold the practice into a larger business—that is the reversal of the secular trend that started in the late 1990s, early 2000s.” On a darker note, there is also fee pressure and regulatory pressure making people want to sell, and if you’re not growing fast enough to keep up with rising costs and fees, that would be another reason to look for a marriage.

Indeed, DeVoe’s deal book says so many small firms were bought in the first quarter of 2017 that it pulled the average AUM of the firms sold down to $600 million from $1 billion in all of 2016.

With some deals, the genesis goes back a long time. Decades ago, the late Quick & Reilly founder Leslie Quick Jr. and late Treasury Secretary William Simon were active in many of the same philanthropies. Their sons, Leslie C. Quick III and Peter Simon, also served on several boards together. Massey Quick, a Morristown, N.J.-based RIA whose average client has about $10 million in assets at the firm, had been looking at offering multi-family office services for several years. Peter Simon and his brother William Simon Jr., had been evaluating continuity and succession options for their single family office, William E. Simon & Sons.

“About a year ago, we began to explore the possibility of merging,” says Leslie C. Quick III. “We were delighted to confirm what we sensed all along —that William E. Simon & Sons could offer our clients a true family office service—something that, until now, we were not offering our clients.”

Besides succession and continuity, Peter Simon says the April 2017 merger, which created a $2.65 billion firm, allowed his family to tap into Massey Quick’s extensive investment capabilities. In the meantime, his Los Angeles-based brother William is overseeing the expansion of Massey Quick Simon on the West Coast. “Like the Simon family, the partners at Massey Quick are in many cases investing side by side with clients,” Peter Simon says.

Another reason people might want to sell or merge is that they are worried about fee compression at a time of more regulatory scrutiny. The DOL rule, however, requiring fiduciary responsibility for retirement plans, has for many RIAs been a boon, since many of them are acting as fiduciaries already, and for that reason, many of them have anticipated that new business will be coming from broker-dealers who will have a harder time following the rule.

Even so, some RIAs say they are still working out the ramifications for their retirement accounts.

One firm among the top 20 financial advisories in terms of assets responded to the Financial Advisor survey with this observation: “With regard to individual clients, because we advise clients on 401(k) rollovers, the rule will likely impact the way that we communicate with clients regarding rollovers, perhaps requiring us to provide additional written disclosures, and may impact our billing practices with respect to these accounts.”

How Does Your Garden Grow?

Jeff Nash, a consultant who works on business deals for RIAs, broker-dealers and hybrids with Charlotte, N.C.’s Nash Consulting Group, says, “At a billion dollars you can’t organically grow enough, and that’s what firms are finding.”

He says real organic growers are hard to come by. But “those firms that are growing organically—with an organic growth strategy that is replicable—are getting a premium for their business.” With two firms that are similarly sized, he says, “you could easily see one firm getting a five times EBITDA [in a sale] and another firm getting a six if one has a repeatable growth strategy.”

For large profitable firms, the prices can go much higher. Speaking at Pershing’s annual Insite conference in San Diego in June, Dynasty Financial Partners CEO Shirl Penney noted the space has been discovered by banks, large family offices and various billionaires who want into the RIA business. In some cases, there are 10 buyers for every seller.

HighTower CEO Elliot Weissbluth told attendees that some buyers are dangling prices of 12 to 14 times EBITDA in front of prospective sellers, though he warned many had their own agenda. “If you want to sell to a molester, you can,” Weissbluth said. “They’re not stupid. They’ve done the math.”

But many of these buyers may be looking to use an RIA’s clients to extract new revenues. Weissbluth depicted these buyers as businesses with “a product component,” while Penney used the term “revenue synergy.”

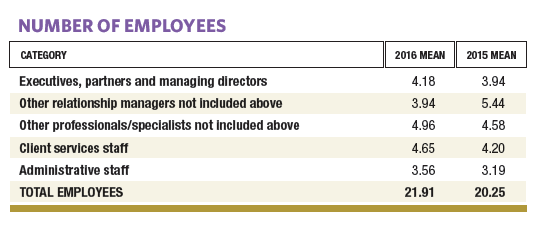

Nash notes that firms growing organically have their employees in well-defined roles, including a number of rainmakers bringing in new clients while dedicated account executives keep existing clients happy.

Successful RIAs are also getting more sophisticated on segmenting clients—tailoring different services with unbundled fees to clients with different levels of wealth to maximize revenue, Nash observes. “In the mass affluent space, they may have a financial plan that they are going to do for the client.” The clients’ investments will be more robo-advisory work for a more modest fee, something below 1%. “Then there would be a financial planning fee that’s unbundled that’s on top of that.”

Money Matters has grown by taking the mass outreach route. Moraif has been a media presence, especially on radio.

Moraif’s most recent shop, after emerging from a couple of predecessor firms, started with $600 million and 1,500 client households. Today the firm works with 7,400 clients and has $3.5 billion in assets under management. The firm has about 30 advisors and around 40 client service associates and offices in several major cities, including Houston, Los Angeles and Phoenix.

Though clients don’t have to be millionaires, the trade-off is that the firm wants to manage most of the clients’ assets—at least 51%. Moraif calls his clients “salt of the earth” people who have worked 20 or 30 years and now are in the decumulation phase and need income and advice on Social Security. Because of the firm’s media profile and investment performance, its growth has all been organic so far, Moraif says. “We’ve looked at acquisition, but for the time being … our philosophy is a little contrary to most advisors. So there is the hurdle of merging cultures.”

Another firm that has thought hard about infrastructure is Akron, Ohio’s Sequoia Financial Group, a firm that said it grew its asset growth 29% in fiscal 2016—which was almost evenly mixed between mergers and organic growth, according to CEO Tom Haught.

Haught started the firm by himself in 1991, focusing on wealth management for private business owners focused in manufacturing hubs like Ohio and Michigan; the firm now has 85% private client business and 15% institutional business focused on retirement plans. The firm’s clients are entrepreneurs whose wealth is often tied up in private business stock, and as their businesses have grown, so has the firm.

Part of the firm’s strategy for growth has been to hire and train people in their 20s. “We decided that rather than trying to take somebody else’s advisor talent, we are going to build our own, so the first investment we made was in building our own talent. We could then train them in our systems.

“So those people are now in their 30s and 40s,” Haught says. “So we have a very strong team of advisors that have 10 years of experience that have come out of CFP programs or come out of a college program. …. I think the great organizations need to make those investments in people before they need them.”

Now, he says those seasoned younger advisors will have the experience to take over the books of retiring advisors whose firms Sequoia has recently begun buying up. “If [firms] have a strong middle, that means they are developing people in their careers, and they’ll be able to have continuity.”

Now, he says those seasoned younger advisors will have the experience to take over the books of retiring advisors whose firms Sequoia has recently begun buying up. “If [firms] have a strong middle, that means they are developing people in their careers, and they’ll be able to have continuity.”

To Market, To Market

Seattle’s Brighton Jones Wealth Management has been thinking about marketing from a new perspective as well. The firm is known for its touch feely, crunchy granola approach, but it’s also a firm heavily embedded in the tech-rich Pacific Northwest among savvy young tech pioneers.

Eight months ago, the firm brought in Microsoft marketing veteran John Dougherty as vice president of marketing. He says that even if RIAs are known for their up-close-and-personal care, there is no doubt they are going to be upset by fintech—the bots, the marketing software, the search engines that have begun anticipating clients’ next searches for help. The industry is moving toward inbound marketing, Dougherty says—which is based more on content development to entice client interest. “The sort of marketing where I think the [RIA] industry is going is a combination … of inbound marketing tied together with paid social marketing, mobile marketing. And that sort of marketing is going to span across high-tech finance and pretty much every other industry.”

Media is bought in real time by computers, he says, and a lot of ads are generated by computers. He says a handful or more RIA firms will also be employing software such as Marketo, a marketing automation platform that tracks leads and knows people’s habits, filtering out those with irrelevant needs and (hopefully) increasing advisors’ return on marketing investment.

Brighton Jones is using Marketo now, Doughtery says, and has also invested in video and owned and operated media and social channels. “Moving ahead, you’ll see us do search engine marketing, we’ll invest more in video and mobile. But what’s really important is we’re going to tie all of our marketing together through marketing automation and make it a lot more personalized.” A lot more content creation is becoming automated, too, he says.

“What we’ll be able to do is take our high-touch approach and extend it through marketing automation.”

Other firms have noted that RIAs aren’t taking the technological challenge as seriously as they should be. Graig Norden, president of tech consultant Freewheel Marketing in San Francisco, said that among the largest RIAs in his research last year, 25.5% were using marketing automation. Among faster growing RIAs, it was 28%, and among asset managers it was 36%. Besides Marketo, there are Eloqua, HubSpot and Pardot.

Steven Swansig, vice president of RIA in a Box, which does a survey of RIAs every year looking at the growth of the industry, says that 75% of the firms it surveyed experienced positive AUM growth in 2016, and that firms aggressively adopting technology for things such as billing, reporting, compliance, client relationship management and aggregation are growing faster.

“We found that the ones that haven’t adopted technology are only growing at around 10% a year and those that are adopting five or more technology systems, which includes compliance, customer relationship management, reporting, billing, maybe an aggregation tool, those are growing at a much faster rate; they’re doing about 25%.”

Swansig says that midsize firms often want to merge so that they can invest together in technology rather than build duplicate systems.

“What was done by people four or five years ago is now all done by computers,” says Dougherty. “I know one of the things we’ll be able to do effectively is take our high-touch approach and extend it through marketing automation. So we’re really going to help our advisors provide the right material at the right time. We’ll really kind of amplify and extend what they already do through technology.”