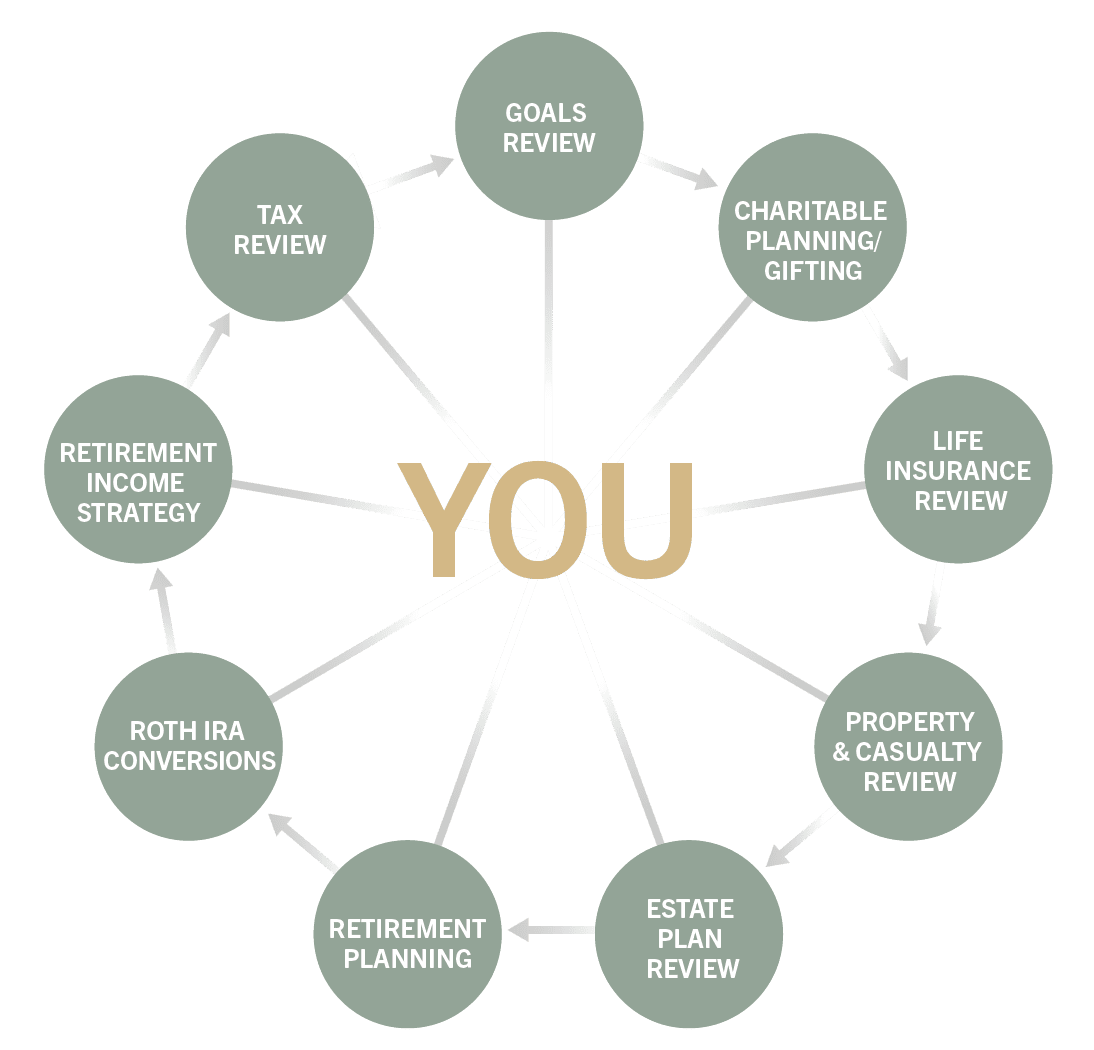

HH’s planning process integrates your interests and needs, adapting to your life choices over time.

your entire financial picture

Funding Your Lifestyle

Today And Tomorrow

Managing assets and cash flow, along with current and future expenses

Protecting

Your Assets

Employing strategies for risk protection—including safeguarding your earning potential

Identifying Tax

Considerations

Strategizing on best-case positioning for your portfolio and income sources

Addressing Estate And

Legacy Matters

Funding your family’s future as well as your philanthropic aspirations

Providing For All

Commitments

Ensuring all your financial promises and responsibilities are sustainable

Reviewing Your Plan

Frequently

Updating as circumstances change; planning is dynamic and collaborative

Goals driven. Not returns driven.

There’s more to a well-lived life than money and resources. HH’s LifePhase Investing® is about building portfolios that will help you reach your goals for every stage of the journey, while addressing concerns about increasing longevity.

Learn about LifePhase Investing®

Discover LifePhase Investing®

A new model of financial planning tailored to your life goals

Build & Grow

This financial phase aligns with your peak earning years, where you gather assets and save. Earning potential, saving discipline, and insurance are crucial.

Transition

The transition phase focuses on strategy execution to shift from earning to reaping rewards. Here, savings and strategizing are impactful as you look toward transitioning to retirement.

Distribute & Deploy

This phase starts when you withdraw from retirement accounts and focus on legacy planning. Strategic investing and withdrawal planning are key to helping your goals progress on stable financial ground.

Our Latest Financial Planning Services Insights

Frequently Asked Questions

What does a financial planner do?

Financial planners help you plan, prepare for, and work toward your future financial goals. Their primary focus is assisting with budgeting, investment strategies, retirement planning, legacy planning, estate planning, tax planning, charitable gifting strategies, and overall financial goal setting.

How many years in advance should my financial planner plan?

Financial planners are professionals who can design both short-term and long-term financial plans. In the short-term, they can review your finances and provide an outlook for the next five years. Financial planners can also project decades ahead to help anticipate how your finances may change at retirement age and beyond. By sharing your financial goals, big and small, your financial advisor can help you plan accordingly.

What is fee-only financial planning?

Financial planners receive compensation for their services in different ways. Many people prefer to work with fee-only financial planners as they are not paid a commission to sell products and may not distracted by other income streams. Fee-only financial planners are fiduciaries, and fiduciaries must put their clients’ interests ahead of their own.

Is it worth paying for a financial planner?

Staying disciplined and true to your goals can be challenging, whether you are committing to fitness or finance. Just as you would see a doctor when you are sick or to prevent illness, a financial advisor can help get your financial house in order. Financial planners are professionals who construct personalized plans designed to optimize your finances to align with your goals. They are trained to put together plans and strategies designed to suit your unique needs and goals and align your financial plan with your lifestyle.

At what income should you get a financial planner?

Different advisors will have varying thresholds of investable assets required to work together. At Halbert Hargrove we believe our services are best aligned with those who have at least $1MM in investable assets.