We understand the second quarter of 2025 may be causing anxiety, as the unknown typically does. While the headlines are unsettling, we remain grounded in long-term thinking and careful portfolio construction, and we’re actively monitoring the situation. Since Halbert Hargrove’s founding in 1933, we have gone through countless cycles of market volatility, and our discipline and philosophy remains unchanged.

In the world of investment management, market volatility is an inevitable part of the journey, and each time it occurs, it’s for a different reason. While it can be unsettling to witness fluctuations in your portfolio, it’s crucial to maintain a calm and composed perspective during these times.

Key points to consider that can help you navigate market volatility

1. Understand Market Cycles

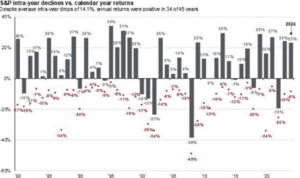

Markets operate in cycles, and periods of volatility are a natural occurrence. For example, on average it is common to have intra year drops of around 14%. Historically, markets have experienced ups and downs, but over the long term, they tend to trend upwards. As shown in the chart, even when there were significant drawdowns in many instance markets finish the year positive.

Chart Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management. Returns are based on price index only and do not include dividends. Intra-year drops refers to the largest market drops from a peak to a trough during the year. For illustrative purposes only. Returns shown are calendar year returns from 1980 to 2024, over which time period the average annual return was 10.6%.

Guide to the Markets – U.S. Data are as of December 31, 2024.

2. Focus on Long-Term Financial Goals

Investment success is often measured over years and decades, not days or months. It’s important to keep your long-term financial goals in mind and not be swayed by temporary market disruptions. Whether you’re saving for retirement, your child’s education, a vacation home, or other significant life events, maintaining a long-term perspective can help you stay focused and avoid panic selling during market downturns.

3. Diversify Your Portfolio

Diversification is a fundamental strategy in managing investment risk. Spreading your investments across various asset classes, sectors, sources of returns, and geographic regions, can help buffer the downside in these volatile markets.

4. Avoid Emotional Decision-Making

Emotions can be a powerful driver of investment decisions, but they often lead to suboptimal outcomes. Fear and anxiety during market downturns can prompt hasty actions, such as selling off assets at a loss. Conversely, overconfidence during market highs can lead to excessive risk-taking. It’s essential to remain disciplined and make decisions based on rational analysis rather than emotional reactions.

5. Stay Informed About Market Conditions, But Don’t Overreact

Keeping informed about market conditions and economic developments is important, but it’s equally crucial not to overreact to every piece of news. Financial markets are influenced by a myriad of factors, and not all news will have a significant impact on your investments. Regularly reviewing your portfolio and consulting with your investment advisor can help you make informed decisions without succumbing to the noise of daily market movements.

6. Trust Your Investment Strategy

You have worked to develop a comprehensive strategy tailored to your life stages, financial goals and risk tolerance, trust in that plan. Market turmoil can test your resolve, but sticking to your strategy is often the best course of action. We are making changes in portfolios as we see fit, and we are here to guide you and provide reassurance during uncertain times.

7. Consider Investment Opportunities

Market downturns can also present opportunities for savvy investors. Lower asset prices may offer attractive entry points for long-term investments. By maintaining a calm and strategic approach, you can potentially capitalize on these opportunities and enhance your portfolio’s future growth. When certain thresholds are met, we will rebalance into equities in an effort to seize these opportunities. We also use these moments, when relevant, to conduct active tax management in accounts that can benefit from it.

While the uncertainty can be overwhelming, we are here for you. Please use us as a resource and know that we are actively monitoring the situation. Please don’t hesitate to reach out to speak with your dedicated team if you have any questions or contact us here.

Halbert Hargrove Global Advisors, LLC (“HH”) is an SEC registered investment adviser located in Long Beach, California. Registration does not imply a certain level of skill or training. Additional information about HH, including our registration status, fees, and services can be found at www.halberthargrove.com. This blog is provided for informational purposes only and should not be construed as personalized investment advice. It should not be construed as a solicitation to offer personal securities transactions or provide personalized investment advice. The information provided does not constitute any legal, tax or accounting advice. We recommend that you seek the advice of a qualified attorney and accountant.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without previous notice. There is no guarantee any forward-looking statement will come to pass. All opinions or views reflect the judgment of the author as of the publication date and are subject to change without notice. All information presented herein is considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. This material should not be relied upon by you in evaluating the merits of investing in any securities or products mentioned herein. In addition, the Investor should make an independent assessment of the legal, regulatory, tax, credit, and accounting and determine, together with their own professional advisers if any of the investments mentioned herein are suitable to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yield may not be a reliable guide to future performance. Any reference to a market index is included for illustrative purposes only as it is not possible to directly invest in an index.