By David Koch, CFP®, AIF®, CFA, Senior Wealth Advisor

It seems like special-purpose acquisition companies (SPACs) are now constantly in the financial news. What’s going on here? In this blog we’re going to talk about SPACs, traditional IPOs, and a relatively new kind of deal, the direct listing.

First, IPOs

Let’s say you and I start a restaurant; we’ll call it Dave’s Vegan Rib Shack (that piqued your interest, didn’t it?). Well, since we’re going to co-own it and we don’t want the full liability of someone getting E. coli – we’d start a company. The legal structure of a company (for example, a C-Corporation) allows us to own shares in the company; it also protects our personal assets. If the company were to go bankrupt, that wouldn’t necessarily bankrupt us as well.

Dave’s Vegan Rib Shack is a private company; you and I own all the shares. Let’s also say that our restaurant does very well, and we open another, and another, and another, and another. A few years later, we have 200 locations across the U.S., and unfortunately, we’re completely inexperienced at running a major corporation. We might then hire a professional CEO from a major restaurant chain to come run our business. And, while we might be collecting a pretty sweet dividend on revenues, we haven’t exactly “cashed out” on all the assets we’ve accumulated.

So, we decide it’s time to do an initial public offering, an IPO. This is when we would enlist the help of an intermediary like an investment bank to go out to their investors and sell them shares of our company; this is called the “roadshow.” We’d release some financial information and the investment bank would give us a target price – let’s say $20 per share. This is called the pre-IPO price. We might decide to sell 70% of the company in this pre-IPO and retain 30% for ourselves.

The investment banks would go to their clients and would sell 70% of our company. On a pre-specified date, we would have our ticker listed on a stock exchange and those shares would start trading in the open market. Now we are a public company. The public can buy and sell shares in our company. This is an IPO.

Good IPOs vs Bad IPOs

What I’ve always thought interesting is how most people think that if share prices go up after an IPO then it was a successful IPO. But if you and I presold 70% of our shares in the pre-IPO for $20 a share, only to watch it skyrocket to $100 a share on the day it goes public, we would feel like we missed the boat. If the public was willing to pay $100 per share of our restaurant company, we should have been selling our shares in the pre-IPO for $100. Getting $20 for an IPO when the market values it at $100 would be a disaster.

On the other hand, if we sold our shares for $100 per share in the pre-IPO, and then they trade down to $20 on the day we went public – we’d feel pretty good about our investment bankers! They pre-sold all our shares for $100 per share to those investors, and the market only thinks they’re worth $20. If I were selling my shares in my company, I’d think the investment banker deserved a raise.

Facts about SPACs

A special-purpose acquisition company (SPAC) is created and funded by investors through an IPO. It involves more or less the same process as an IPO – except the regulatory approval process is much quicker because there isn’t an operating company that’s going public. A SPAC is basically a bank account with a bunch of cash in it. The SPAC then goes looking for private companies to purchase.

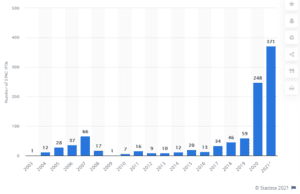

Since the SPAC’s shares are already being traded in the open market, when a SPAC purchases a private company it essentially takes the company public, but without the regulatory process or roadshow involved with the traditional IPO. The SPAC process has been around for many years, but most people have just heard about them recently because of the recent SPAC frenzy in the market. Just look at the chart below. The number of SPAC IPOs has skyrocketed in the last two years:

Since buying a share in a SPAC is essentially buying both 1) a share of cash in a bank and 2) a promise to buy a good private company, they’re often called “blank check companies.” One thing investors in SPACs should be acutely aware of is: Who is the sponsor? Who can sign those blank checks? In other words, who is doing the deals?

Because of all this SPACtivity (see what I did there?), not only are longtime investors getting in on this SPAC bonanza, as expected, like Bill Ackman and his Pershing Square Capital Management SPAC or Alec Gores’ Gores Holdings SPACs. So are celebrities and (celebrity) athletes. Serena Williams sits on the board of Jaws Spitfire Acquisition Corp. Alex Rodriguez is the CEO of Slam Corp. Steph Curry is part of the SPAC team at Dune Acquisition Corp, and Shaquille O’Neal serves as a strategic adviser for Forest Road Acquisition Corp. II – can we call this one the Shaq SPAC?

The SPAC Whack

There were more SPAC IPOs in the first quarter of 2021 than in all of 2020. Because of this frenzy, the SEC has been trying to put a wet blanket on things. I love Shaq, but the SEC came out with an investor alert in March 2021 stating, “It is never a good idea to invest in a SPAC just because someone famous sponsors or invests in it or says it is a good investment.” But what if it is Shaq? I love consuming his endorsements like Papa John’s Pizza, Gold Bond foot powder, Ring cameras, and Oreos – but I’m not sure about investing in them.

In April, a month later, the SEC issued guidance on how SPACs need to report their warrants. Essentially this meant they all had to go hire more accountants and revalue their financial statements. And in May, the SEC put out, “What You Need to Know About SPACs – Updated Investor Bulletin.” This one is actually a good read if you’re interested in learning more. They could have just called it SPAC Facts, but I digress. Wet blanket and all, SPACs are still on fire in 2021.

Selling Dave’s Vegan Rib Shack to a SPAC

Instead of going to an investment bank to go the traditional IPO route, we might be approached by, or seek out the sponsor of, a SPAC as a buyer of our company. We would sit down with them and do what would otherwise feel like a private business sale, i.e., no roadshow. Except in the end, stock of our Dave’s Vegan Rib Shack restaurants would be able to be traded in the public markets. For us, a SPAC deal is attractive because it is likely going to be much quicker and less complex than a traditional IPO process.

The Elusive Direct Listing

A direct listing is sometimes referred to as a direct listing process (DLP) or direct public offering (DPO). This is when a company creates and sells shares directly into the public markets without the use of an investment bank. This can save the company money as investment bank fees are typically in the 3-7% range; without the middleman, a direct listing can be done for far less.

Some also consider a direct listing to be somewhat more of an egalitarian process. Shares are offered on an exchange and buyers and sellers match bids and arrive at what everyone agrees to be the fair price. No fat cat Wall Street I-bankers are made any fatter in a direct listing. It may, then, come as no surprise to find that the first direct listing was Ben & Jerry’s, the ice cream hippies, in 1984.

Direct listings have historically been quite rare, and mostly isolated to very small companies. But times they are a’changing. They are now gaining in popularity with larger companies as well. Spotify (SPOT) had a massive direct listing in 2018 (current market cap over $47bil), followed by Slack (WORK) in 2019 (current market cap over $26bil). In 2021 so far, we’ve seen four and they’re all pretty big: Roblox at $46bil (RBLX), Coinbase at $47bil (COIN), SquareSpace at $7bil (SQSP), and ZipRecruiter at $2.6bil (ZIP).

Unlike with a SPAC, companies that want to direct list must still publicly file with the SEC and will be subject to the same reporting standards as an IPO. I believe that part of the SEC’s concern with SPACs is that in some ways SPACs bypass their oversight – this is not the case with a direct listing. A direct listing still has to go through the SEC’s meat grinder.

A direct list of FOOD

So let’s say we decide to direct list our restaurant corporation. We would have to go through the SEC’s process, pick a ticker (the ticker FOOD is available, so is ELON – just a suggestion!), and then convince an exchange like NYSE or Nasdaq that we’re worth their time to list. The rest is up to us to generate a buzz before our big day, release some press releases, etc. There is no one to blame but ourselves if no one wants to buy our stock.

The big advantage of an IPO or a SPAC over a direct listing is price certainty. We made a deal with an investment bank (in the case of an IPO), or with a SPAC ahead of the first day of trading. By the time our stock starts trading we’ve essentially already been paid, money has already exchanged hands. The stock that gets traded around after that is largely being traded among stock investors.

With a direct listing, there’s no certainty. We don’t know exactly how the market will value our stock. We might think it’s worth $30 a share, but what if no one buys it for $30? The only offers that are coming in are at $10 a share. So that’s all it’s worth: $10. If we went into a direct listing thinking the market would pay $30, but it only pays $10, we would be tremendously disappointed.

Let’s Make a Deal

So, there are the three key types of deals for taking your company public. I hope that now you can use some of these fun facts to win friends and influence people, and speaking of Let’s Make a Deal, if Monte Hall asks you if you want to switch doors – always, always, always switch! But we’ll have to save our discussion of Bayes Theorem and conditional probability for another time. Want to connect, email me here.

How do you balance having the life you want to enjoy today with what you’re going to need in the future? Are you doing what it takes to enter your dream retirement? TAKE OUR QUIZ to find out.

Disclaimer:

Halbert Hargrove Global Advisors, LLC (“HH”) is an SEC registered investment adviser located in Long Beach, California. Registration does not imply a certain level of skill or training. Additional information about HH, including our registration status, fees, and services can be found at www.halberthargrove.com. This blog is provided for informational purposes only and should not be construed as personalized investment advice. It should not be construed as a solicitation to offer personal securities transactions or provide personalized investment advice. The information provided does not constitute any legal, tax or accounting advice. We recommend that you seek the advice of a qualified attorney and accountant.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without previous notice. There is no guarantee any forward-looking statement will come to pass. All information presented herein is considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. This material should not be relied upon by you in evaluating the merits of investing in any securities or products mentioned herein. In addition, the Investor should make an independent assessment of the legal, regulatory, tax, credit, and accounting and determine, together with their own professional advisers if any of the investments mentioned herein are suitable to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yield may not be a reliable guide to future performance. Any reference to a market index is included for illustrative purposes only as it is not possible to directly invest in an index.

Sources Consulted:

Athletes And Celebrities Join The SPAC Boom, SEC Takes Notice – Crunchbase News

Blank Checks Are Rarely Good. Are SPACs The Exception? (forbes.com)