By Nick Strain, CFP®, CPWA®, AIF®, Senior Wealth Advisor at Halbert Hargrove

If you purchased a home in the last three years, you should consider refinancing now

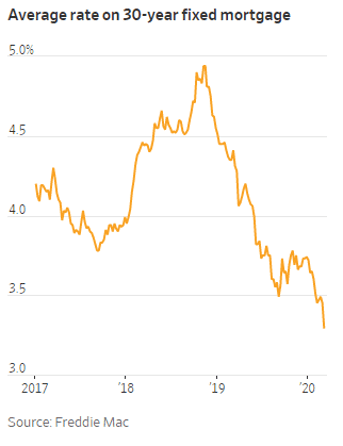

Have you purchased a home in the last three years? Or are you carrying an interest rate above 3.5%? Right now, mortgage rates are at a three-year low (as shown in the below chart). This opens up the opportunity for you to refinance. Currently, for borrowers with good credit, 30-year fixed rates are available at 3.375%, 30-year jumbo[1] mortgage are at 3.5% and 15-year fixed mortgage rates are at 2.99%.

There are a few key factors to refinancing your mortgage:

- How much you will save by refinancing?

- What are the costs?

How much will you save by refinancing?

There are two basic ways to look at how much you’d save: How much your monthly or annual payments would go down, and how much you’d save in terms of the amount of interest you’d pay over the course of the loan.

Let’s look at an example:

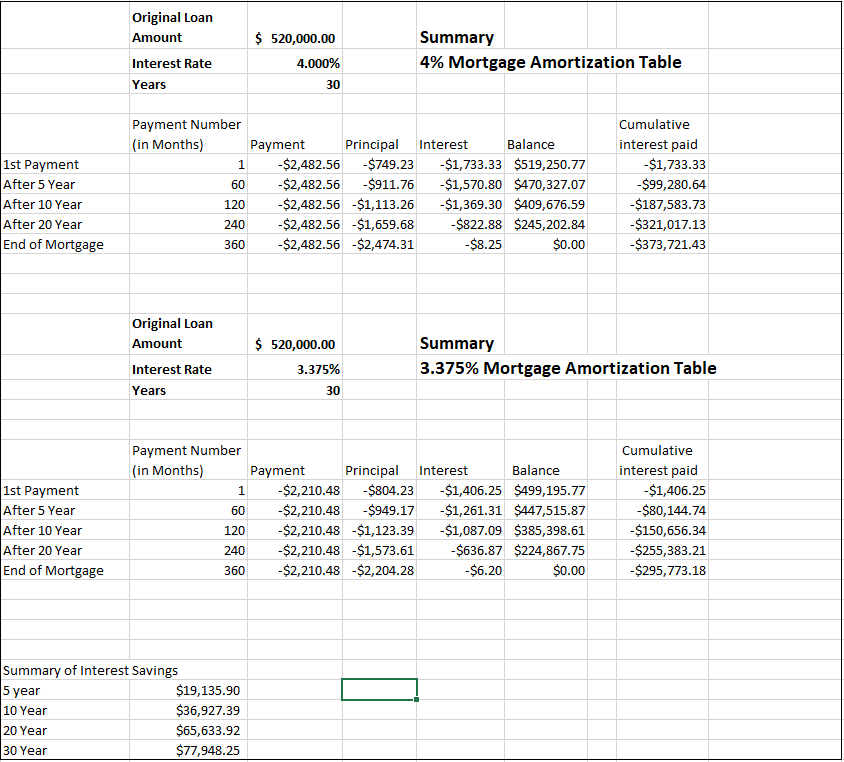

A person purchased a home two years ago for $700,000, made a down payment of $180,000, and took out a 30-year mortgage of $520,000 with an interest rate of 4%. The current monthly payment is $2,482.56. After two years of making payments, the mortgage balance is now $501,312.

Let’s round down to $500,000 to make things simple. A borrower with a good credit score can now refinance her mortgage from 4% down to 3.375%. If she refinanced her $500,000 mortgage to a new 30-year mortgage at 3.375%, this would result in a monthly payment of ,210.

48. That would represent a savings of $272.08 a month ($3,264.95 annually).

A different way of looking at how much she’d save is by calculating how much less she’ll pay out in interest payments each month over the course of the loan. Using the example above of reducing her interest rate from 4% to 3.

375% on a $500k mortgage, she would save a total of $19,135.90 over five years, $36,927.39 over a 10-year period and ,948.

25 over a 30-year period. The amortization charts on shown below for additional information.

What are the costs of refinancing?

Costs can range depending on the loan amount, but the best way to pay the least amount of fees is to create a more competitive environment among three or four different banks.

To get a competitive rate, shop your potential refinance to your current bank(s) where you have a checking and/or savings account. Then go to one or two of the large banks and then to an independent mortgage broker. Let each company know that you are shopping your refinance with two to three other lenders. Bank and mortgage brokers have a little room to match rates and decrease costs when they know they are in a competitive situation.

To determine the breakeven of these costs to refinance, you will want to divide the costs by your monthly mortgage payment savings. This will yield the number of months it will take to make the refinance. For example, if it costs ,000 to refinance and the monthly savings is 2.

08, then it will take 3.6 months to break even.

Should you wait to refinance to wait for lower rates?

Mortgage rates could possibly go even lower, but it’s important to also take advantage of the current interest rate environment to decrease your current monthly mortgage and create savings now. If mortgage interest rates continue to decrease, then you can refinance in the future and continue to save on your mortgage.

Questions?

We’d be happy to walk you through your specific numbers or answer any questions you may have. To discuss your specific situation, please reach out to your Halbert Hargrove team.

[1] County-specific loan amounts for jumbos are above about $765,600.

For more information or questions, please contact Halbert Hargrove at hhteam@halberthargrove.com