By Brian Spinelli, CFP®, AIF®, Chair of Investment Committee/Senior Wealth Advisor at Halbert Hargrove

After a very calm 2021, financial markets did an about face. It’s hard to avoid hearing about all the worries from war, to inflation, to rising interest rates and market declines without losing your composure. And it’s all too easy to think things aren’t going to get better.

We’re writing to share knowledge about historical trends that we hope will be useful. One of our many priorities right now is to help you navigate this tough period. We’ve seen these kinds of market behaviors before, and this is not going to be our last experience of them.

In fact, this kind of market volatility is not out of the ordinary – the market calm we experienced in 2021 was more extraordinary than what we’re experiencing this year.

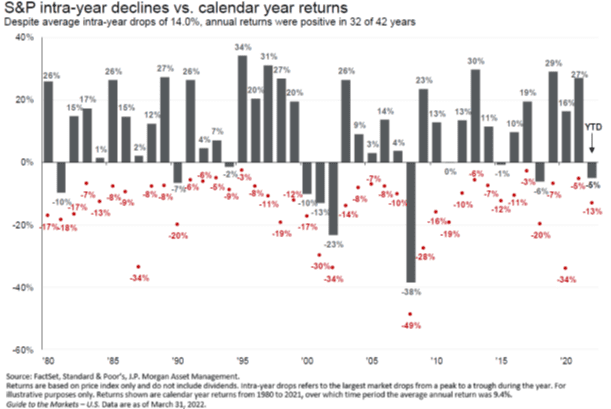

Intra-year declines vs. calendar year returns

The chart below illustrates this. There’s a good chance you’ve seen it at some point, either in a recent meeting with us or in comments we’ve shared in the past. It’s a history of S&P 500 US stock index returns going back 42 years. The gray bars represent the total calendar year performance for S&P 500 stocks in each of those 42 years. The red dots represent the largest intra-year drop observed each year.

One key thing to pay attention to: Many of the red dots represent double-digit declines, yet in 75% of these years, the US stock market finished the year in positive territory.

Don’t bet against an eventual recovery

Betting against historic market behavior – thinking this time is different – can be hazardous. Reasons for market declines and volatility are always different, but how the market reacts and recovers tends to follow quite similar patterns. Further, markets don’t wait for the “all clear” to start rebounding. In fact, typically, the rebound starts when everything feels the darkest.

Of course, we can’t be sure this volatile period is behind us, but what we do know is that by the time things seem like they’re back to some semblance of normal, the markets will have already moved and priced that in advance. This picture only represents one area of the investment markets, but it’s an area that tends to get the most attention and angst. If you’ve been working with us for a while, you’ve probably seen your portfolio change over the past few years. Alternatives to traditional stocks and bonds have come into portfolios to further help diversify your holdings – and help you to ride through these periods with less turbulence.

Today’s headlines are unnerving for all of us. But in terms of the investment markets, we need to stay focused. In stressful times, discipline is critical to staying on course with a portfolio that’s appropriate for your specific goals and financial situation.

History is on your side in these moments. Please don’t hesitate to reach out to your service team at HH if you’d like to discuss your strategy and any concerns you may have in more depth.

Disclaimer:

Halbert Hargrove Global Advisors, LLC (“HH”) is an SEC registered investment adviser located in Long Beach, California. Registration does not imply a certain level of skill or training. Additional information about HH, including our registration status, fees, and services can be found at www.halberthargrove.com. This blog is provided for informational purposes only and should not be construed as personalized investment advice. It should not be construed as a solicitation to offer personal securities transactions or provide personalized investment advice. The information provided does not constitute any legal, tax or accounting advice. We recommend that you seek the advice of a qualified attorney and accountant.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without previous notice. There is no guarantee any forward-looking statement will come to pass. All opinions or views reflect the judgment of the author as of the publication date and are subject to change without notice. All information presented herein is considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. This material should not be relied upon by you in evaluating the merits of investing in any securities or products mentioned herein. In addition, the Investor should make an independent assessment of the legal, regulatory, tax, credit, and accounting and determine, together with their own professional advisers if any of the investments mentioned herein are suitable to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yield may not be a reliable guide to future performance. Any reference to a market index is included for illustrative purposes only as it is not possible to directly invest in an index.